There are plenty of investments that can attract people because of the benefits and monetary gain. People consider their life insurance as a way of having a financial backup if anything happens or if someone dies, but sometimes circumstances change, and people’s motives and goals change too. So one of the available options is a life settlement. Let’s take an in-depth look at how they work.

What is a life settlement?

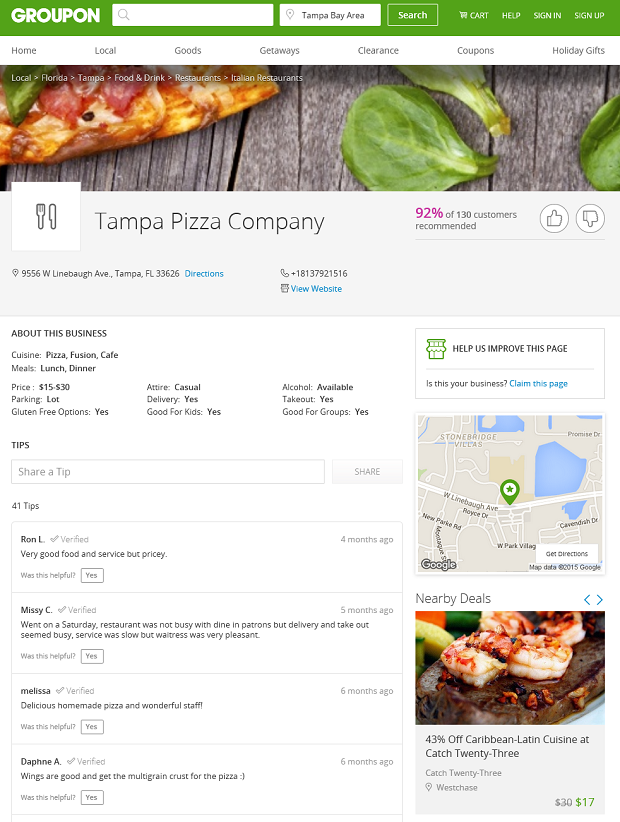

This is basically a transaction between an owner of a life insurance policy and a third party investor. The policy owners sell it for a one-time lump sum cash payment. The amount that the buyer pays is usually less than the benefits received from the policy if a death occurred, and the new beneficiary is mostly experienced institutional investors that help create a secondary market for life insurances. Some people might confuse it with a viatical settlement, but they are slightly different. This settlement needs the person insured to have a life expectancy that is less than 24 months, which is defined by the department of insurance, but if it’s more than 24 months, then it’s considered a life settlement.

When does it happen?

Some people call it a senior settlement, and people give up what they had for a decent amount of cash when they are in need. People’s lives and financial positions change randomly, so that money could be of use. That’s why it’s important to consider how different insurance policies can impact you. Some people might reach the point where they can’t keep paying anymore, or they want to avoid taking a loan against it or surrendering the policy back to the company after reaching a certain age. No matter what kind of deal you had with the life insurance, you should think about the best action to take that suits you. You should find experienced life settlement firms with proper licensing and multiple years of positive past performances. They make things a lot easier and help the process go smoothly.

Who would buy it from you?

These purchasers are usually in companies. They never interact with you when you’re trying to sell your policy. You have to get in touch with a settlement broker who would connect you with that potential buyer. The broker will then carry out the necessary procedures to get it done for you. These brokers have a fee for their services, so be prepared to pay a small percentage of what you’ll get to them. They list your policy to bigger brokerage firms to get competitive bids, so the chances of finding a buyer are much higher. Their work is regulated by state authorities, so everything is done properly.

How can you become eligible?

To determine your eligibility for your life settlement, you have to use a life settlement calculator. Keep in mind that potential buyers may not purchase the policy if you are terminally ill. The policy you have must be universal life, convertible form, or whole life. Generally, it has to have a minimum face value of 100 thousand dollars, and you have to be at least 65 years old or above. Figuring out the value of your policy depends on a few factors, such as your medical condition and age.

Is it legal?

It’s completely legal, and you shouldn’t worry about such transactions. Supreme courts declare your insurance as your personal property, so it can be sold, given away, or traded to the right buyer. Legally, your insurance company can’t deny your request to sell it; this is not within their right, and you can’t be prevented from doing so. It’s recommended that you think about the move and how it can affect your taxes since your settlement procedures might be taxable. It’s prudent that you fully understand all the tax implications for selling it.

The reviewing process

Your broker and the buyer’s representatives will go through all the paperwork and medical reports presented to them, calculating the real value of your policy and deciding if making an informal offer is valid at this point or not. They will still carry on with the necessary steps to gather all the information needed. Make sure that everything is submitted because these reports are crucial for calculating the offer, and they will want to give you the maximum amount as an offer to meet your financial needs.

What happens after the sale?

When your broker finally finds the right buyer for you, a nice and hefty sum will be issued to you, and you will no longer worry about the premium payments. You might be required to update some of your health information occasionally. You will pay the fees or commissions needed for the process, and then you will be fully free from any responsibility regarding the policy. However, you might be able to keep some of the retained death benefits without even paying for the premiums.

Are you safe doing it?

It’s completely fine to carry on with the process if you feel like it’s the right decision for you, and it’s allowing you to change your financial situation when you’re in a tight situation and can’t continue paying for the insurance. Also, you are not fully obligated to sell it if you aren’t comfortable with the offer. Accepting the offer is a big decision that needs a considerable amount of thinking. Luckily, if you want to change your mind, you have a 15-day rescission period to decide if you want to sell or not. The period might be less or more depending on where you live because the rules differ.

Everyone has the right to sell their insurance. They are considered assets under federal law. Depending on the financial situation of the owner, selling it can be quite useful, but it does come with some tax consequences. You need to make sure that this move is the best course of action you can take to avoid lapsing or surrendering back to your insurance carrier, so be sure to get advice from your financial advisors or accountants. This will make things less of a hassle for you.