The constant rise in the cost of hospitalization has generated a renewed interest in health insurance among the masses and a higher number of people are opting for health insurance as compared to a few years back when it wasn’t given as much importance as it should have gotten.

Today, medical insurance plans are considered as important as getting a life insurance policy; not only does it protect you from the adverse effects of the steep rise in the costs of getting proper medical care, but it also helps save taxes, making it one of the most viable pieces of investments you can make.

Over the years, the insurance sector has grown so much that today you can find tens of hundreds of plans to choose from. That begs the question, “Which ones can be considered to be the best medical insurance plans?”

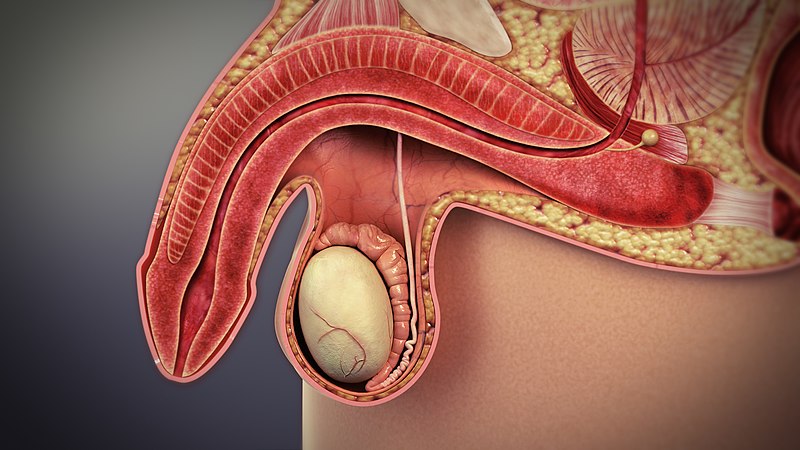

Image Source: Shutterstock

First off, there isn’t just one but many contributing factors that make up a good health insurance plan, and we will look at a few of them in this article.

Figure Out Your Requirement

The kind of coverage you need depends on your lifestyle, the number of people seeking cover, and the amount of premium you can afford without pinching your wallet. The needs of an individual are completely different when compared to someone looking to insure their entire family; therefore, you need to first figure out your requirement. Do your research, go through plans that offer the exact benefits you are seeking, and then choose one that ticks all the right boxes.

Affordability

There is a plethora of medical insurance plans available in the market suited towards a range of requirements. Once you have figured out your requirement, you need to look at how much premium you can afford to pay without having to break the bank. It’s always best to purchase a plan that’s reasonably priced to start off and then based on changing requirements you can always upgrade the plan later on in life. The idea is to get an initial cover that offers an extensive list of benefits at a low-cost premium.

High Claim Settlement Ratio

An insurance policy is only good when it offers what it promises when you most need it. Always choose an insurance provider with a good track record in claims settlement. It won’t do you any good if you require treatment and it takes a lifetime to settle your bills; therefore, it’s always a good idea to buy insurance only from top-tier reputed health insurance providers to save you from a heartbreak later on.

Compare Quotes Online

It’s the internet age and all information is available at the click of a button. Therefore, make sure that you do a thorough comparison of medical insurance plans before choosing one. These days you also have the option of requesting a quote based on your specific requirements, so it’s always a good idea to get as many quotes as you can to choose a plan that offers maximum benefits at an affordable premium.

Care Health Insurance offers some of the best medical insurance plans in the country with comprehensive coverage and also provides coverage for robotic surgery and Ayush treatment. They have a 100% in-house claims settlement team with an impressive 95.2% claims settlement ratio for the financial year 2019-2020. They have an extensive list of premier hospitals in their network across India and offer all-round coverage catering towards individual requirements.

Choosing an insurance policy that’s just right for you is crucial to safeguard your health and to meet the rising cost of healthcare in India. So, go online, compare to choose the best one and get insured for a better healthier future.